COURSES SYLLABUS

HARDWARE AND NETWORKING CERTIFICATE COURSE

TALLY WITH GST CERTIFICATE COURSE

TALLY COURSE SYLLABUS

This comprehensive certification from Tally intends to recognize certified candidate as an expert in accounting on Tally.ERP 9. Candidates successfully completing the online assessment will earn a verifiable digital certificate from Tally.Tally GURU certifies candidate as highly experienced on Tally.ERP 9 and well-versed with principles of accounting, inventory, taxation and payroll.

Chapter 1: Fundamentals of Accounting

Introduction Accounting Terms Accounting Assumptions, Concepts and Principles Assumptions Concepts Principles Double Entry System of Accounting Types of Accounts Golden Rules of Accounting Source Documents for Accounting Key Takeaways Practice ExercisesChapter 2: Journalising and Posting of Transaction

Introduction Recording of Business Transactions The Accounting Equation Recording of Transactions in Books of Original Entry/Journal Use of Debit and Credit Rules of Debit and Credit Recording of Business Transactions in Journal Ledger Need for Ledger Differences between a Journal and a Ledger Classification of Ledger Accounts Posting from Journal Trial Balance Methods of Preparation Subsidiary Books & Control Accounts Cash Book Single Column Cash Book Double Column Cash Book Three Column Cash Book Petty Cash Book Purchase Book Purchase Return Book Sales Book Sales Return Book Journal Proper Control Accounts Financial Statements Trading and Profit & Loss Account Trading Account Profit & Loss Account Balance Sheet Types of Assets and Liabilities included in Balance Sheet Key Takeaways Practice ExercisesChapter 3: Maintaining Chart of Accounts in Tally.ERP 9

Introduction Getting Started with Tally.ERP 9 Mouse and Keyboard Conventions Company Creation Shut a Company Select a Company Alter a Company Company Features and Configurations Company Features: F11 Configuration: F12 Chart of Accounts Ledger Group Ledger Creation Single Ledger Creation Multi Ledger Creation Altering and Display of Ledgers Ledger Alteration Single Ledger Display Multi Ledger Display Deleting Ledgers Group Creation Single Group Creation Multiple Group Creation Altering and Display of Groups Group Alteration Single Group Display Multi Group Display Deleting Groups Key Takeaways Shortcut Keys Practice ExercisesChapter 4: Fundamentals of Inventory Management

Introduction Inventory Management Terms Used in Inventory Management Inventory Valuation Different Types of Inventory Valuation Inventory Management in Tally.ERP 9 Conclusion Practice ExerciseChapter 5: Stock Keeping Units

Introduction Inventory Masters in Tally ERP 9 Creating Inventory Masters Creation of Stock Group Creation of Unit of Measure Creation of Stock Item Creation of Godown Defining of Stock Opening Balance in Tally ERP 9 Key Takeaways Shortcut Keys Practice ExercisesChapter 6: Recording Day to Day Transactions

Introduction Business Transactions Source Document or Voucher Recording Transactions in Tally.ERP 9 Accounting Vouchers Receipt Voucher Contra Voucher Payment Voucher Purchase Voucher Sales Voucher Debit Note Voucher Credit Note Voucher Journal Voucher Creation of New Voucher Type Automation of Invoices (Voucher Classes) Non-Accounting Vouchers Memorandum Voucher Optional Vouchers Reversing Journal Recording Provisional Entries Recording Inventory Vouchers Receipt Note Voucher Delivery Note Voucher Rejection In Voucher Rejection Out Voucher Stock Journal Voucher Physical Verification of Stocks Conclusion Key Takeaways Shortcut Keys Practice ExercisesChapter 7: Accounts Receivable and Payable Management

Introduction Accounts Payable and Receivable Maintaining Bill-wise Details Activation of Maintaining Bill-wise Details Feature New Reference Against Reference Advance Reference On Account Credit Limit Activate Credit Limit Setting Credit Limits Exceeding Credit Limits Exception to Credit Limits Payment Performance of Debtors Changing the Financial Year in Tally.ERP 9 Conclusion Key Takeaways Shortcut Keys Practice ExercisesChapter 8: Banking

Introduction Banking Payments Setting up Banking Features Cheque Management Cheque Printing Single Cheque Printing Multi Cheque Printing Cheque Register Cancelled Cheque Blank Cheque Bank Reconciliation Manual Bank Reconciliation Auto Bank Reconciliation Deposit Slip Cash Deposit Slip Cheque Deposit Slip Payment Advice Managing of Post-dated Cheques Notional Bank Post-dated Report Handling e-Payments in Tally.ERP 9 e-Payments Report Exporting e-Payment Transactions from e-Payments Report Sending Payment Instructions to Bank Updating the Bank Details Instantly in Tally.ERP 9 Conclusion Key Takeaways Shortcut Keys Practice ExercisesChapter 9: Allocation and Tracking of Expenses and Incomes

Introduction Cost Center and Cost Categories Activation of Cost Category and Cost Center Allocation of Expenses and Incomes using Cost Center Allocation of Expenses and Incomes using Cost Center with Cost category Allocation of expenses to multiple cost centers and costcategories Automation of Cost Center and Cost Categories while recording transactions Cost Center Classes Cost Center Reports Category Summary Cost Center Break-up Ledger Break-up Group Break-up Conclusion Key Takeaways Shortcut Keys Practice Exercises

Chapter 10: MIS Reports

Introduction Advantages of Management Information Systems Types of MIS Reports in Tally.ERP 9 MIS Reports in Tally. ERP 9 Trial Balance Balance Sheet Profit and Loss Account Cash Flow Statement Funds Flow Statement Ratio Analysis Books and Accounting Reports Day Book Receipts and Payments Purchase Register Sales Register Bills Receivable and Bills Payable Inventory Reports Stock Summary Stock Transfer Movement Analysis Ageing Analysis Key Takeaways Shortcut Keys Practise ExercisesChapter 11 Storage and Classification of Inventory

Introduction Godown Management Activating Godown Creating a Godown Allocation of Stock to Particular Godown while Defining Opening Balance Recording of Purchase, Sales and Stock Transfers with Godown Details Purchase of Inventory Recording stock transfer entry using stock journal Sale of Inventory Maintaining Damaged Goods Analysing Godown Summary and Stock Movement Reports Stock Category Activation of Stock Categories Creating Stock Categories Recording of Transactions Movements of Goods in Batches/Lots – Batch wise details Activating Batch-wise Details in Tally.ERP 9 Using Batch-wise Details in Purchase Invoice Using Batch-wise Details in Sales Invoice Expired Batch/Stock Transfer Batch Reports Batch Vouchers Report 2 Batch Summary Report Transfer Analysis report Stock Valuation Methods Configuration of Stock Valuation Method Different Types of Costing Methods Recording of Purchase and Sales Transactions Stock Valuation based on FIFO Perpetual MethodConclusion Key Takeaways Shortcut Keys

Chapter 12 Management of Purchase and Sales Cycles

Introduction Purchase Order Processing Activating Order Processing in Tally.ERP 9 Sales Order Processing Viewing Order Details Display Columnar Orders & Stock Details Sales order outstanding. Pre-closure of Order Reorder Level Display Reorder Status Conclusion Key Takeaways Shortcut Keys Practise ExercisesChapter 13 Price Levels and Price Lists

Introduction Activating Price Lists and Defining of Price Levels Creation of Price List Using Price List Revise Price List Conclusion Key Takeaways Shortcut Keys Practice ExercisesChapter 14 Manufacturing Process

Introduction Activating of Bill of Materials Auto Listing of Components Using Bill of Materials Accounting of Manufacturing Process in Tally.ERP 9 Reports Stock Journal Register Transfer Analysis Cost Estimation Stock Ageing Analysis Transferring of Manufactured Goods from Storehouse to Showroom Conclusion Key Takeaways Shortcut Keys Practice ExercisesChapter 15 Goods and Services Tax

Introduction to GST Getting Started with GST (Goods) Advance adjustments and Entries (Goods) Getting Started with GST (Services) Advance adjustments and Entries (Services) Conclusion Key Takeaways Shortcut Keys Practice ExerciseChapter 16 Tax Deducted at Source (TDS)

Introduction Basic Concepts of TDS TDS Process TDS in Tally.ERP 9 Activation of TDS Feature in Tally.ERP 9 TDS Statutory Masters Configuring TDS at Group Level Configuring TDS at Ledger Level Booking of Expenses in Purchase Voucher Recording Transactions Expenses Partly Subject to TDS Booking Expenses and Deducting TDS Later Accounting Multiple Expenses and Deducting TDS Later Accounting for TDS on Advance Payments against Transport TDS on Expenses at Lower Rate TDS on Expenses at Zero Rate Deducting TDS on Payments Reversal of Expenses with TDS Deducting TDS on Expenses with Inventory Accounting TDS on Fixed Assets Payment of TDS TDS Reports Challan Reconciliation TDS Outstandings E-Return Conclusion Key Takeaways Shortcut Keys Practice ExercisesChapter 17 Securing Financial Information

Introduction Security Control Activation of Security Control and Creation of Security Levels in Tally.ERP9 Accessing the Company with Data Operator’s User Account Password Policy TallyVault Password Activation of TallyVault in Tally.ERP 9 Configuration of TallyVault Password while Creating the Company Configuration of TallyVault Password for Existing Company Benefits of TallyVault Password Conclusion Key Takeaways Practice ExercisesChapter 18 Data Management and Financial Year End Process

Introduction Backup and Restore Backup of Data Restoring Data from a Backup File Export and Import of Data Exporting and Importing of Data from One Company to Another in XML Format Exporting of data in other available formats E-Mailing in Tally.ERP 9 Printing Reports Managing of Data during Financial Year End Process Important Pre-Split Activity Splitting of Data Key Takeaways Shortcut Key Practice ExercisesChapter 19 Goods and Services Tax

Introduction Activate GST in Tally.ERP 9 Accounting of GST Transactions Purchases from Unregistered Dealers Imports Advance Receipts and Payments Accounting Advance Receipt and Sales Invoice in the samemonth. Advance receipt and sales invoice recorded in different

months Reversal of GST on account of cancellation of advance

receipt Accounting an advance payment for purchase of taxable

goods under reverse charge Mixed Supply and Composite Supply under GST Mixed Supply of Goods Composite Supply of Goods Accounting of Service Transactions GST Reports Generating GSTR-1 Report in Tally.ERP 9 Generating GSTR-2 Report in Tally.ERP 9 Input Tax Credit Set Off GST Tax Payment Time line for payment of GST tax Modes of Payment Challan Reconciliation Exporting GSTR-1 return and uploading in GST portal.

Chapter 20 Filing of TDS Returns

Introduction TDS Reports Form 26Q TDS Outstandings Payment of TDS Challan Reconciliation E-Return Key Takeaways Shortcut Keys Practise ExercisesChapter 21 Tax Collected at Source

Introduction Basic Concepts of TCS Configuring Tally.ERP 9 for TCS Enabling TCS in Tally.ERP 9 Sales of TCS Goods at Lower Rate Sales of TCS Goods at Nil Rate TCS on Transfer of Right to Use Payment of TCS TCS Reports Form 27EQ Saving Form 27EQ Return Transaction Book Key Takeaways Shortcut Keys Practice ExercisesChapter 22 Job Costing

Introduction Features of Job Costing Enabling Job Costing Creating Required Masters Creating Ledgers for Job Costing Recording of Job Costing Related Transactions Job Costing Reports Job Work Analysis Report Materials Consumption Summary Report Comparative Job Work Analysis Report Key Takeaways Shortcut Keys Practice ExercisesChapter 23 Job Work

Introduction Features of Job Order Processing in Tally.ERP 9 Configuring Job Order Processing in Tally.ERP 9 Company Setup Enabling Job Order Processing Voucher Type Setup Job Order Processing Job Work Out Order Job Work In Order Job Order Reports Job Work Out Reports Key Takeaways Shortcut Keys Practice ExercisesChapter 24 Tally Audit

Introduction Enabling Tally Audit Features in Tally.ERP 9 Create User level security Creation of Masters by Administrator Recording of Transactions by the Users Audit Listing for Voucher Types Tally Audit Statistics for Masters Audit Listing for Users Key Takeaways Shortcut Keys Practice ExercisesChapter 25 TallyVault

Introduction How to Configure TallyVault Configuration of TallyVault Password while Creating the Company Configuration of TallyVault Password for Existing Company Alteration/Change of TallyVault Password Benefits of TallyVault Key Takeaways Practice ExercisesChapter 26 Synchronization

Introduction Data Synchronisation in Tally.ERP 9 Difference between On-demand Synch and Online Synch Features of On-Demand Synchronisation On demand Synchronisation Sync Status Messages Online Synchronisation Online Synchronisation using Tally.Net Export Snapshot Import Snapshot Transaction Sync Summary Report Status Report Exceptions Report Key Takeaways Shortcut Keys Practice ExercisesChapter 27 Multi-Lingual

Introduction Operating System Requirement for Multi-lingual Support Keyboard (Language) Configuration in Tally.ERP 9 Defining User Interface Language Key Takeaways Shortcut Keys Practice ExercisesChapter 28 Control Centre

Introduction Login to Control Centre Control Centre for an Account Licensing and Configuration License and Configuration for Single Site Licensing and Configuration for Multi-site Creating Configuration Set for a Site TDL Configuration Management Jobs & Recruitment Account Profile Management Change Account Admin Change Password Change My Profile My Sessions User Management Manage Data Sessions Deploying Account TDLs Unlink TDL Configuration Support Centre Key Takeaways Shortcut Keys Practice ExercisesChapter 29 SMS Query

Introduction How to Configure SMS in Tally.ERP 9 Key Takeaways Practice ExercisesChapter 30 Web Publishing

Introduction Key Takeaways Practice ExercisesChapter 31 Group Company

Introduction Consolidation of the Final Reports by Creating a Group Company How to check the Consolidated Reports in the Group Company Key Takeaways Shortcut Keys Practice ExerciseChapter 32 Payroll

Introduction Setup Payroll in Tally.ERP 9 Company Creation Activation Processing Basic Payroll in Tally.ERP 9 Employee Setup Creation of Payroll Units Attendance/Production Types Creation of Pay Heads Defining Salary Details for an Employee Defining Salary Details for an Employee Group Salary Processing Payroll Reports Statements of Payroll Attendance Reports Expat Reports Payroll Statutory Deductions and Reports Creating the Statutory Pay Heads Define Salary Details Process Salary Payment of Salary Payroll Statutory Reports Income Tax Employee Setup Provide Income Tax Details Process Income Tax Process Salary Key Takeaways Shortcut Keys Practice Exercises

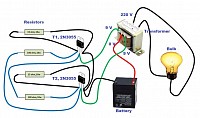

Electronic certificate course syllabus

Course Topics

Lesson 1 Fundamentals of Electricity

Lesson 2 Voltage and Current

Lesson 3 Power Supplies and Simple Circuits

Lesson 4 Resistor Circuits and Ohms Law

Lesson 5 Resistor Networks

Lesson 6 Capacitor Circuits

Lesson 7 Fundamentals of Magnetism

Lesson 8 Inductor Circuits

Lesson 9 Building Electronic Circuits

Lesson 10 Introduction to Semiconductor Devices

Lesson 11 Electronics Applied: Transformers

Lesson 12 Electronics Applied: Basic Communication Circuits