HOME

Founder Member

"I am deeply honored to inform that Triveri Sangam Charitable Trust, Sangamner has directly or indirectly played a crucial role in carving a new niche for our students. During the last two Yeasr, the institute has taken a giant leap in introducing conventional, vocational, career,skill and job-oriented programmes at undergraduate, postgraduate and research levels benefiting thousands of students and empowering a large number of rural women girl students. The vertical and horizontal expansion of the Trust campus into an academic center of excellence has put our Trust on the educational map of the country. While assuming the captaincy of this trust. I am overwhelmed by sincere feelings of reverence, awe and gratitude.

As a Founder Member, leading this Trust offers a really big challenge as one has to match one’s performance with the predecessors. Moving in gear with time, we have to grow at the speed of thought to register even the eye-blink changes. Further moving in synch with time, we must empower and strengthen our conventional courses with information technology and its mega reach. We are taking every step to strengthen our supremacy in academic and research programmes, infrastructure, placements, extension, co-curricular and extra-curricular activities."

Prof. R.B. Nagare

Founder Member

COURSES AFFORDED BY TRUST

- TALLY ERP WITH GST

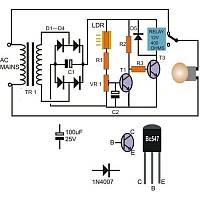

- ELECTRICAL AND ELECTRONIC FOR HOME APPLIANCES

- BASIC + ADVANCE MS- OFFICE

- HARDWARE AND NETWORKING

The journey of GST started way back in 2000, when the Atal Bihari Vajpayee government first thought of exploring the avenues of GST in the country. 14 years later, the potential GST Bill benefits were brought up for discussion once again, ultimately leading to GST becoming the law of the land by the President’s assent on 8th September, 2016.

While every change has its pros and cons, GST is no different. However, it is expected that one will be able to see significant GST benefits for the common man, as well as for the business community, in the long run.

However, as we have embraced GST on 1st July, some of the immediate GST advantages are as follows:

It is a good way to become ‘Industry ready’

Being ‘Industry ready’ is something that holds much value these days. Industries value candidates who already possess skills that they otherwise have to ‘teach’ new recruits via training programs.

After pursuing this course, you will possess skills that will help you directly take on important roles within an Industrial plant. And companies love this, since they won’t have to waste much resources towards training you and help you fit into their ‘system’.